Table of Content

Fantastic response, proactive and courteous response of the officials and timely and adequacy of credit made available. No unnecessary formalities and procedures are very simple and fast. It was a pleasure and extremely satisfying experience with iserve Financial. I found Iserve Financial Team professional, straightforward, and since they don't push you to apply for a specific bank, they are impartial. On a long term basis one needs an intermediary as a one stop shop and these guys seems to be in the business for long term.

You can also increase your down payment component of the loan for even lower EMIs. Home loan EMI is the amount that is paid to the lender for repayment of the borrowed loan to finance your home. At the time of availing a home loan, EMI is calculated by your lending institution based on the borrowed amount, approved rate of interest, and loan tenure. Now, you can easily do it using PNB Housing’s home loan repayment calculator. ICICI Bank is a leading name in the private banking sector and the best bank for home loan in Hyderabad. With more than 4050 branches, ICICI Home Loans can be easily accessed by borrowers.

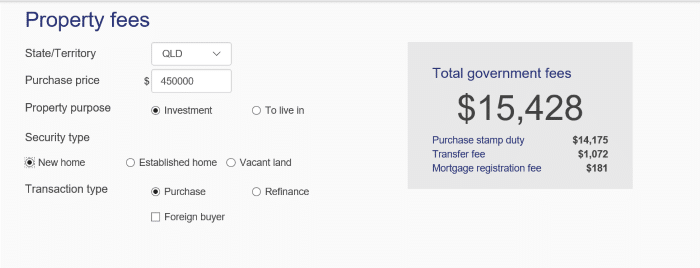

Tools & Calculators

So, if you earn your monthly salary is Rs 25,000, you can get a loan amount of Rs 15 lakh approximately. Banks and financial institutions typically ask their customers to furnish some important documents to assess their eligibility. There may be some specific requirements depending on the lending institution where you are applying for the loan, the type of home loan, and various other factors. As a general rule, your home loan EMI starts the following month when your home loan amount is disbursed.

Other important factors include your age, qualification, number of dependants, your spouse's income , assets & liabilities, savings history and the stability & continuity of occupation. With this option you get a longer repayment tenure of up to 30 years. This means an enhanced loan amount eligibility and smaller EMIs. FLIP offers a customized solution to suit your repayment capacity which is likely to alter during the term of the loan. The loan is structured in such a way that the EMI is higher during the initial years and subsequently decreases in proportion to the income. Having a good CIBIL score is essential so that you face no hassles when obtaining a home loan.

What is the maximum purchase price I can afford?

A higher credit score of usually above 800 can greatly help enhance your home loan eligibility as they imply a high repayment capacity. Thus, you can keep a regular check on your credit score to avoid defaults and possible loan rejection. The age and location of the property you have selected are among the crucial factors that lenders consider when approving a home loan. It is the security against which you avail of the loan.

I hereby authorize HDFC Ltd. and its affiliates to call, email, send a text through the Short messaging Service and/or Whatsapp me in relation to any of their products. The consent herein shall override any registration for DNC/NDNC. Please click here to go to English version of the same page.

Home Loan in Hyderabad Details

Loans starting from Rs.5 lakhs to Rs.10 crores are available which can be repaid back within a maximum of 30 years. ICICI Home loans do not require any guarantor and Home loan interest rates in Hyderabad are 8.70% to 8.85%. With increases in demand for housing and space requirements, the price of houses has also, quite naturally, increased. There is a report that indicates that the city has seen a close to 30% increase in housing prices. There are a number of financial institutions, both banks and non-banking financial companies that offer home loans in Hyderabad. For home loan eligibility, Individuals should have a minimum of 21 years of age and a maximum of 75 years of age inclusive of the repayment period.

A home loan is a type of secured loan that you can borrow from a bank or a non-banking financial institution. Home loans are availed for a stipulated period at a specific interest rate to buy, construct or renovate a home. As it is a secured loan, home loans require the borrowers to put down the property as collateral against the loan amount. Lenders do have the right to seize the property if the borrower is unable to pay the loan amount on time.

However, the lender has the right to revoke the sanction letter if they find any discrepancies with the property. As the home loan amount usually ranges between lakhs and crores, lenders need some assets as security if a borrower cannot repay the loan. For home loans, the property for which the loan is taken becomes the collateral. The lender has the right to seize the pledged collateral if the borrower defaults in repaying the loan amount. As lenders finance only up to 80% of the property’s value as a loan, the rest has to be paid by the borrower out of his/her own pocket.

This way, you won’t have to repay the existing loan or get a new one. Home Construction LoanIf you wish to construct a house on a plot that you own in Hyderabad, you can apply for this loan. The lender will visit the plot and have a detailed discussion with you regarding the costs. After assessing your eligibility, the lender will sanction the loan. Navi made the process of securing a home loan very easy. Legal verification and valuation of the property went smoothly.

PNB Housing Finance, a NBFC, offers various types of home loans which start at Rs.5 lakhs only. Even the interest rate is competitive and loans are offered at both fixed rate and floating rate. At an Initial I took home loan from DHFL on sudden from their end transferred the process to INDIA BULLS without any intimation. But one issue was faced that my documents not submitted to INDIA BULLS hence I have submitted again.

Moreover, the loan application would get rejected if the tenure is longer than the remaining years of the property. Hence, banks usually conduct a technical and legal investigation of the property before sanctioning the loan. The source of income and job stability for salaried individuals, for example, are taken into consideration by financial institutions when approving loan applications. Similarly, self-employed individuals can be eligible for a loan if they prove they have a steady income source. If you are just taking a home loan, first of all, check out how much EMI you are eligible for with a house loan calculator tool. Now, to reduce it further, consider increasing your tenure or going for better rates of interest.

Final eligibility will be determined based on various other parameters including Grihashakti’s policy at the time of loan application. Availability of housing loans in Hyderabad for up to 30 years with low monthly EMI until the age of 70. As the demand for housing increases, so does the price of housing.

QUICK HOME LOAN HYDERABAD is a one stop shop for all your financial needs, including Home Loans, Personal Loans, Credit Cards, Business Loans and Balance Transfers among others. With our internally developed highly proficient Loan Calculator algorithm, we provide the best options and deals for the loan/financial product of your choice. Our algorithmic engines help you by using strong factual data made from relative latest changes in the market and a calculated understanding of the futuretrends. Our algorithmic engines help you by using strong factual data made from relative latest changes in the market and a calculated understanding of the future trends. It can be used by a person if they want to build a home rather than buy one that has already been built.

In this formula, P stands for principal, R denotes the monthly interest rate divided by 100, and N indicates loan tenure in months. Navi offers home loans at attractive interest rates starting from 7.39% p.a. With Navi, you can apply for a housing loan in Hyderabad from the comfort of your home. All you have to do is download the Navi app and fill in your personal and employment details. After the successful completion of KYC verification, your home loan will be approved.

Simply fill in the required Principal loan amount, interest rate , and the loan term. Before applying for a home loan, it is crucial to understand the eligibility criteria to avoid loan rejection that can impact your credit score. Home loan eligibility refers to the parameters based on which all banks and non-banking financial companies evaluate the creditworthiness and repayment capability of the loan applicant.

No comments:

Post a Comment