Table of Content

I have read the Privacy Policy & Agree to Terms & Conditions and authorize Dialabank & its partner institutions to Call or SMS me with reference to my application. Maximum Rs.2.00 lacs or 10% of original housing loan whichever is lower. 4 Months from the date of pre-approved sanction letter. Further, request for extension of the time/validity shall not be considered. 75% of the project cost of construction or purchase price of house/flat as per agreement for sale. Loan is also available for furnishing of house property.

EMI refers to the ‘Equated Monthly Installment’ which is the amount you will pay to us on a specific date each month till the loan is repaid in full. After getting an estimate of EMI using the calculator, you can apply for a home loan online from the comfort of your living room easily with Online Home Loans by HDFC. Home Loan EMI Calculator assists in calculation of the loan installment i.e. It an easy to use calculator and acts as a financial planning tool for a home buyer. I have read the Privacy Policy and the Terms and Conditions. I provide consent for my data to be processed for the purposes as described and receive communications for service related information.

Home Loan By Banks

If you own a private limited company, your home loan financer will require the documents of your company as well as your personal documents. Latest 3 years audited report- including Balance sheet, Profit & loss account, list of creditors and debtors, all the schedules of balance sheet, form 3cb and 3cd etc. I took home loan from MAGMA HOUSING FINANCE on 6 months back , the loan duration of 20 years for the amount of 18L. HDFC people guided to take Pradhan Mantri scheme for the home loan. The amount was sanctioned of 25L and subsidiary amount of 2.67L. The process was good hence they have sanctioned the loan within 20 days.

Avail a home loan at best interest rates from a bank or any other financial institution in the city. The bandwidth of a home loan is not confined to buying a home alone. You can avail a home loan for several other purposes like purchasing a land to construct a home, renovation, extension and furnishing of homes, etc. PNB Housing is the answer to your search for a rapid, customized, hassle-free, and easy-to-get home loan in Hyderabad. It offers a range of incentives for all those wishing to fulfill their goals of owning or building a dream house, with the attractive interest rates on the market. HDFC will determine your Home Loan Eligibility largely by your income and repayment capacity.

HomeLoan: Home Loan EMI Calculator - HDFC Home Loans

You can calculate the EMI both manually and with the help of a calculator. The Navi Home Loan EMI Calculator lets you get an EMI estimate in seconds. Just enter the loan amount, repayment tenure and interest rate. The online EMI calculator will display the monthly repayment amount in seconds. A home loan is an amount that you borrow from a lender to own a property of your choice.

So, if you earn your monthly salary is Rs 25,000, you can get a loan amount of Rs 15 lakh approximately. Banks and financial institutions typically ask their customers to furnish some important documents to assess their eligibility. There may be some specific requirements depending on the lending institution where you are applying for the loan, the type of home loan, and various other factors. As a general rule, your home loan EMI starts the following month when your home loan amount is disbursed.

Home Loan Eligibility for Top Home Loan Providers in India

Mentioning all your additional income sources is one of the important things you can do to increase your debt to income ratio, thus improving your loan eligibility. For instance, if you own another house, you can rent it out and declare the additional income in the loan application. Your net income will determine the EMI you will be able to pay while meeting your monthly expenditures. Most banks/ lenders decide the loan amount up to 60 times one’s monthly salary.

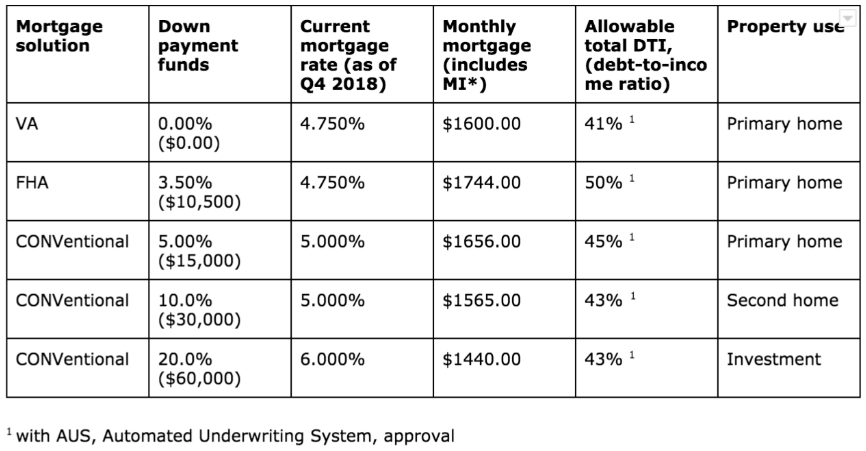

Enjoy attractive interest rates starting at 8.39% p.a. The rate of interest on your home loan is calculated monthly. Salaried and self-employed must have an annual income of ₹ 1,80,000 and ₹ 1,80,000-3,00,000, respectively, to pass the eligibility test.

What Components are Included in Home Loan EMI?

Once done, our representative will soon contact you for a further stress-free process. The applicant must be between the age group of 18 years to 65 years. Extension of Mortgage on the House property already mortgaged to the Bank. Top-up loan in any case will not exceed original home loans amount.

This option provides you the flexibility to increase the EMIs every year in proportion to the increase in your income which will result in you repaying the loan much faster. These calculators are provided only as general self-help Planning Tools. Results depend on many factors, including the assumptions you provide.

Loans - The word itself creates a havoc, but it was not the case in Iserve Financial Pvt Ltd. It is fast/quick, reliable, transparent and getting a loan is fabulous, with just a click. Loan process is so great.The disbursement was very speedy,want to maintain the relationship for long term.

The service and attention to detail I received from iserve Financial was outstanding. Before I started the refinance process I spoke with one of the managers from iserve for over an hour. In my head I had one idea of what I wanted to do but she was able to offer me several different options, some I never even consider. I found the entire team to be very skillful in assisting me and I am comfortable and confident of the decision we made together. They were able to set me up with a loan that will enable me to pay off my loan quicker and save me money at the same time.

Since I am going to buy a plot so taken this loan offer. Maintaining a good CIBIL score is a good practice as every financial institution strictly examine the detailed behavior of the previous loans taken. This includes details on the type of loan taken and the loan amount you have borrowed.

There are more hidden charges which was informed later this was the only issue. I have been informed that will receive Rs.7000 to 8000 due to good credit score but it was not happened. A home loan applicant may also take use of additional services including home loan top-ups and debt transfers. The financial assistance provided by banks and other financial institutions to obtain a home loan in addition to their primary loan is known as home loan top-up.

'Click Here to Know the Prevailing Home Loan Interest Rates'

Home loan balance transfers enable borrowers to transfer their loans from one financial institution to another in order to benefit from the second institution’s advantages. Home Loan eligibility refers to how much money you’ll get to buy a house and whether you’ll be approved for a loan. Certain factors, such as the applicant’s age, income, type of employment and property, credit score, and many others, must be considered to determine your home loan eligibility. Getting a home loan in Hyderabad is easy with the Navi app.

No comments:

Post a Comment